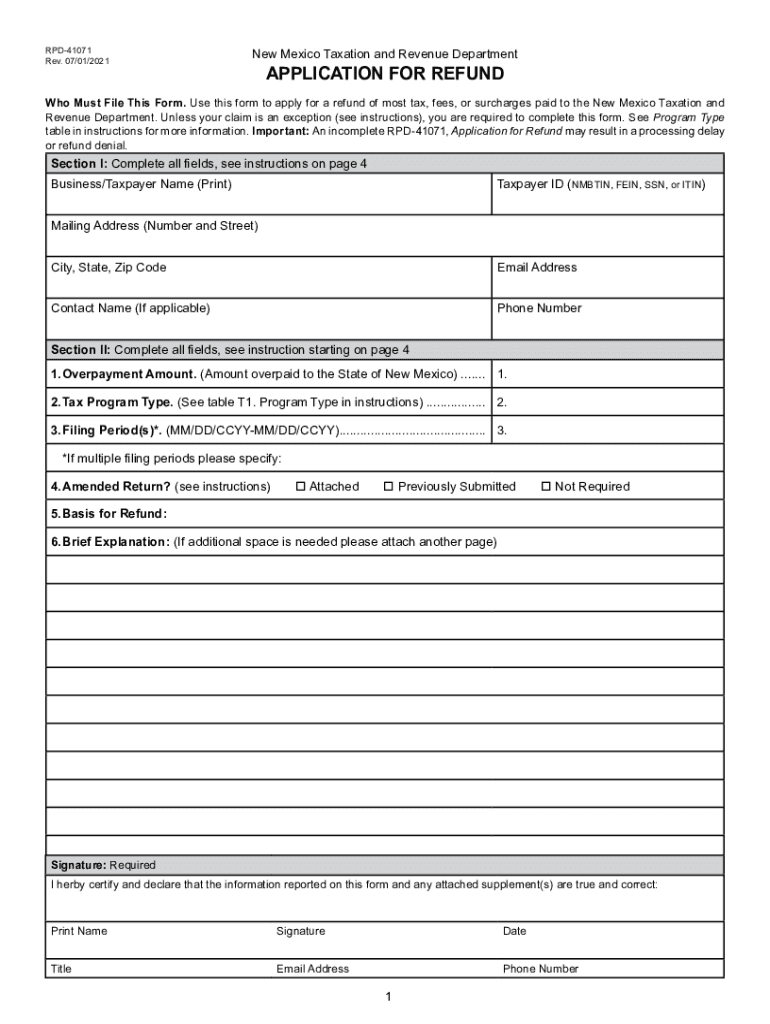

Who needs form RPD — 41071?

A taxpayer who resides in New Mexico may file form RPD — 41071 or as it is known — Application for Refund.

What is form RPD — 41071 for?

Form RPD — 41071 is used to claim for refund from New Mexico Taxation and Revenue Department. An individual may ask for a refund of tax or other fees based on the previous income tax.

Is form RPD — 41071 accompanied by other forms?

Form RPD — 41071 is the main document to claim for a refund with. But a taxpayer may write an application refund letter instead providing substantial ground for a refund there. If you choose to claim for a refund with form RPD — 41071, you should enclose a number of attachments. Look through the list of required attachments in the instructions provided within the form itself.

When is form RPD — 41071 due?

Form RPD — 41071 is due when it is needed. The refund claim has no power until it is completed and verified.

How do I fill out form RPD — 41071?

Application for refund is preceded with brief instructions. In total, the form consists of three pages. On the first page there are fields to be completed with:

- taxpayer's name

- address

- identification number

- the period and the taxes overpaid

- reasoning for refund

The second page provides fields to be completed with taxpayer's account number so that the refund could be directed straight to the account.

Next there fields for department use.

Where do I send form RPD — 41071?

Completed form RPD — 41071 with all necessary attachments should be mailed to the Taxation Revenue Department. The exact address is given at the bottom of the first page of the form.